You’ve heard the expression “Don’t keep all your eggs in one basket” but does this apply to your personal investments? The answer is YES and it couldn’t be truer than for your own investment portfolio.

The good news is that India is a nation of savers and the bad news is that you are saving your money in mainly fixed deposits and larger amounts in real estate (thanks to demonetization those days of storing currency under your mattress are gone! Which is good, as cash lying at home isn’t earning anything).

Some people believe or are aware of only one asset class and invest all their money into that. Fixed deposits (FDs) have been a popular choice till now. However, since the rates got slashed from 8% to 6% over a two-year period middle-class Indians are looking for alternatives.

Real estate has been is another popular choice, however we have seen that property prices don’t just go up. The bubble can/has burst this is especially true post-demonetization. Also if you think about it, is investing only in property a good idea? What if you just need a fraction of the money for an immediate expense? An example could be an emergency operation. If the property isn’t on rent then you have 2 options. The first option is to take a LAP (loan against your property current rate approx. 9%). The second option is to sell the property, it would be very hard to sell your property according to your expectation and you would have to liquidate the total asset (i.e. you can’t just sell a proportion of your real estate).

A fundamental principle for your personal investments should be diversification. The best way to do this is spreading your investments amongst various asset classes based on your preferences (non-finance jargon: invest in different products that don’t overlap).

There are several asset classes. The most common are Fixed deposits (FDs), stocks, bonds, cash, mutual funds, real estate, precious metals (we Indians love Gold!), commodities, private equity and even collectibles (such paintings, antiques).

When planning your financial future you need to determine your financial needs. Remember every individual’s needs are different. So, if you are also looking at investing for older family members their needs will be much different than yours. Start by asking yourself the following 5 questions:

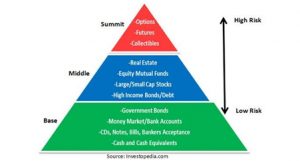

1. What is my investments time horizon? As a general principle you should have 3 time periods in mind in a proportion similar to that shown in this triangle.

a. Short term think of this as the cash you need for you day-to day expenses, investments that are easy to liquidate in a short time (Asset classes to consider: Cash in your current bank account, Liquid funds).

b. Medium term: With a little

planning you can save and invest

to meet you medium term

expenses more efficiently. It can

cover events such as a child’s

college education, wedding

expense, help you children with a deposit on their first home, medical expenses etc. (Asset classes to consider: Fixed deposits, Mutual funds (can be pure equity, pure debt or a balance of debt and equity), Stocks, Real estate (esp. if you are flipping i.e. buy a house that needs to be renovated below market price taking advantage of the fact that its currently a buyers market, then renovate it and flip it i.e. sell it at a profit or put it on rent for a steady monthly income).

It can

cover events such as a child’s

college education, wedding

expense, help you children with a deposit on their first home, medical expenses etc. (Asset classes to consider: Fixed deposits, Mutual funds (can be pure equity, pure debt or a balance of debt and equity), Stocks, Real estate (esp. if you are flipping i.e. buy a house that needs to be renovated below market price taking advantage of the fact that its currently a buyers market, then renovate it and flip it i.e. sell it at a profit or put it on rent for a steady monthly income).

c. Long Term: This would include your old age & retirement planning. In addition to tax efficient government schemes such as Jandhan Yojna, you could set aside a portion of your monthly salary into a SIP (systematic Investment plan which essentially takes money directly from your bank account for a set amount on a set date and invests in a particular product.) the great thing about this is the sooner you start the better no matter how little you start with –thanks to the wonder of compounding* ( Asset classes to consider: Gold – considered a good hedge against the stock market basically, if the market goes down gold will go up and vice versa, Life Insurance , Stocks especially in large cap/blue chip companies names you are familiar with and with which you have the confidence, Pension , Real Estate, invest in equity funds via SIP -systematic investment plans (a similar concept to US’ 401K retirement plan).

Note: The list of asset classes to consider is not exhaustive and various assets can and will over-lap in time-horizon.

2. What is my appetite for risk i.e. how comfortable am I with risk? All investments are subject to risk some more so (like equity) than others (like FDs).

a. Are you a Risk Seeker? Usually riskier assets have a higher return potential. Of course the downside is also much higher (think gambling it’s all or nothing).

b. Are you Risk averse? If you are risk averse and you don’t like any risks you should be comfortable with a lower return as there is also a lower risk to your investment.

3. What is the current interest rate? As mentioned earlier in this blog the interest rates have fallen in the last few years. So, it’s the perfect time to reassess how you want to invest in FDs vs. other asset classes. It could be that you are over 60 years of age and do not want any risk then FD would make sense. However, if you are younger willing to take on a little risk then your could consider mutual funds.

4. Tax Implications: Consider the various tax implications for various asset classes. The Government is pushing the country to invest more sophisticatedly so there are favourable tax treatments for certain investment such as Mutual funds.

Equity returns (both stocks and equity mutual funds) are tax-exempt after one-year holding period.

Debt Mutual funds have a tax rate of 20% after indexation benefits after three years now compare this to the traditional FD where, the interest earned on bank fixed deposits are treated in the same tax slab as the investor’s income (if you are in the higher tax bracket you’ve already paid 30% on your income and are now paying 30% tax on FD income—essentially you are paying double tax!).

5. Country political/economic landscape: No one could’ve predicted the Modi Governments move to demonetisation last year. If possible try to have some kind of investment in a foreign country this sounds easy but in practice it isn’t so. Also, the Governments’ recent cash injections to PSUs (such as Punjab National Bank etc.) is likely to result in some movement in the Bond market.

Conclusion: The next time you are going to make a decision on where to invest your hard-earned money do keep this article in mind. Recognise and understand your financial needs and remember diversification is key.

I’ve tried to make this blog without much financial jargon however, there may be a few terms referred to in this blog. See below for meaning behind these terms

*Compounding is a direct realization of the time value of money, is also known as compound interest . For example, suppose a Rs.10,000 investment in Company X earns 20% the first year. The total investment is then worth Rs.12,000. Next, assume that in the second year, the investment earns another 20%. In year two, the total balance of Rs.12,000 would earn 20%, ending with a value of Rs.14,400 instead of Rs.14,000. The extra Rs.400 of growth is due to the Rs.2,000 earning of year one also growing at 20% in year two, along with the principal.

Source:- www.investopedia.com

I would love to hear your comments and feedback on this blog (use comment section below). Also, if there is a specific money matters topic that you would like me to cover in the future please email me at shivani@momschi.com

Very informative article.

Good Advice